4 Property trends to take note in 2021

The 2020 ‘Circuit Breaker’ resulted in market fluctuations in the property market due to increased uncertainty. Public health measures have invariably changed consumer patterns and lifestyles. However, business impacts were cushioned by the government’s effective stimulus and reliefs that have managed to keep businesses afloat and prop up occupier demand. As soon as movement restrictions eased, the property market progressively recovered with the number of transactions sharply increasing across many sectors.

In light of the release of vaccines in 2021, global markets have been looking towards steady recoveries and further price growth. According to Collier, investor optimism and economic growth can be seen through property sales that are expected to return to pre-covid levels by the end of the year.

The pandemic has altered property trends and birthed new investment opportunities for buyers. A 25.8% rise in real estate investment sales in Q1 2021, mainly led by commercial and industrial properties, shows that stronger sales are to be expected with Singapore’s strategic handling of the pandemic and image as a safe haven for investors.

1. The K- Shaped Recovery

As the economy recovers from one of the worst recessions, it is common to see an uneven rate of recovery, as some industries experience quicker bounce back than others.

The K-shaped economic model shows how some working professionals from high-growth and well-performing sectors such as technology, healthcare, and fintech, have been able to cope well. On the other hand, hard-hit industries such as hospitality, retail, and aviation are struggling for survival.

The ability of the real estate market to provide long-term stable returns might be attractive to investors who are considering relocating their funds. The increased accessibility for the affluent to acquire capital has also allowed for them to grow their existing investment portfolios.

According to a 2020 UBS/PwC Billionaires Insights report, the collective fortunes of billionaires soared by US$2 trillion (S$2.65 trillion) amid the Covid-19 crisis. The purchasing of many high-end properties may explain the strong performance of Singapore’s luxury home segment during the pandemic.

Property Prices to Rising due to Diminishing Home Supply

Land sales have declined, with 20-30% fewer projects launched in 2020, as compared to 2018 and 2019. One of the biggest factors was the cooling measures implemented in July 2018, halting almost all collective sale activities.

With a higher net absorption rate in the past few years, the number of unsold, uncompleted private homes has been reduced. The shrinking supply of homes, alongside a more desirable macroeconomic outlook, has increased prices of private homes by 2.1% QoQ in Q4 2020. Furthermore, the pent-up demand for homes due to further delays in construction caused by the pandemic will likely drive up prices even more.

3. Rise in HDB Resale Transactions

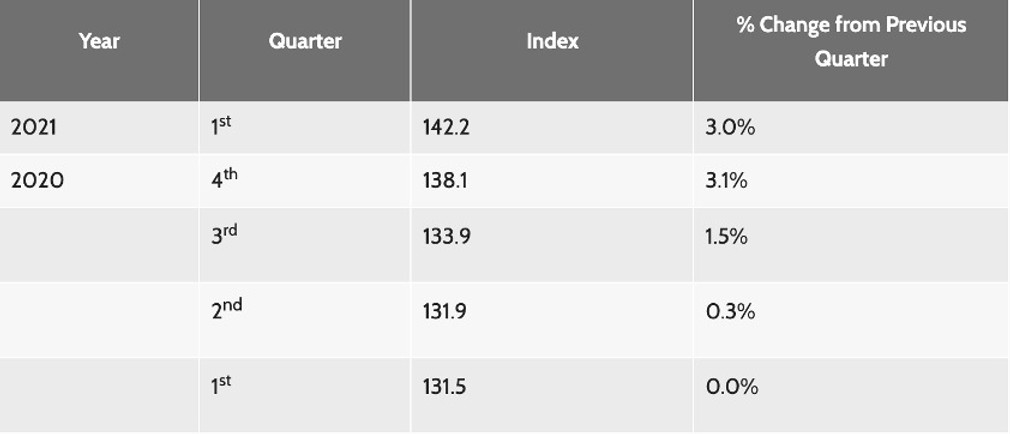

HDB resale transaction volume in 2020 is 13.5% higher than the annual average of the previous 5 years. This increase in volume is a result of the Government’s efforts to increase the attractiveness of older HDB flats and make housing more affordable for Singaporeans.

Despite the pandemic and price increases, the number of transactions rose 1.5 times in the second half of 2020. The increase in resale home asking prices is partially due to sellers taking full advantage of the increased demand. According to HDB, the Resale Price Index is seen to be on a constant rise, picking up pace in Q1 2021.

The prices of resale flats are estimated to increase up to 4% in 2021, along with HDB resale volumes anticipated to rise up to 10%, to around 25,000 units this year.

Read also: What are the different stamp duties for property?

4. Keep Watch of Popular Blockbuster Launches from Latest Collective Sales

The upcoming blockbuster projects are the final portion of the 2017 to 2018 collective sale cycle’s private homes to be launched. One of the most anticipated developments is Park Nova. The former Park House was sold en bloc for a ground-breaking $2,910 per sqft per plot ratio in 2018.

The luxury segment launches include Midtown Modern, Cairnhill 16, One Bernam, Park Nova, Klimt Cairnhill, and Perfect Ten. Some launches from the mass-market segment include The Reef at King’s Dock, One-North Eden, The Ryse Residences, Phoenix Residences, Provence Residence, and Parc Central Residences.

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.