Singapore’s Non-Landed Private Residential Market Outlook

As 2019 comes to a close, we will be taking a closer look at what’s happening in Singapore’s non-landed private residential property market thus far.

Rising Property Prices

Property prices for the private residential (non-landed) market have been on the rise despite the recent round of cooling measures in 2018. The higher Additional Buyer Stamp Duty (ABSD) and Loan to Value (LTV) limits did not seem to deter would-be property buyers, with property prices continuing to trend upwards in 2019, rising 1.3% in 2019 Q3 compared to the previous quarter.

Property analysts had attributed this to the unrest in Hong Kong as well as the rising tensions between China and the USA. The Singapore property market has seen increasing interest from Chinese buyers, looking to protect their capital and hedge against their own currency risk in Singapore.

Read also: 4 property trends to take note in 2021

Falling Vacancy Rates

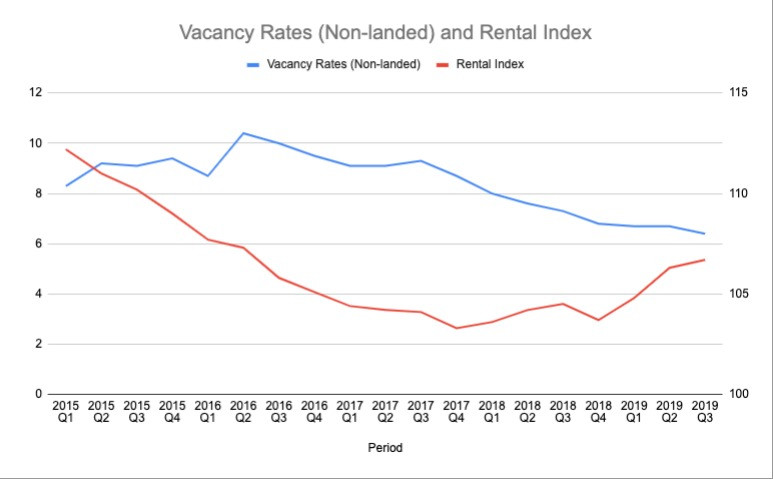

Vacancy rates have been trending downwards, from a high of 10.4% in 2016 Q2 to a low of 6.4% in 2019 Q3. This corresponds to the fall in the rental index in the same period, which indicates that many property owners have relented in lowering their asking rental instead of leaving their units vacant.

In 2019, the rental index picked up slightly, which could be caused by a scarcity in desirable units (due to falling vacancy rates) and an emerging trend for Singaporeans to rent instead of purchasing a private home due to changes in the LTV limits. There is no evidence that this rise in the rental index is caused by an increase in the ex-pat population (The non-resident population grew by less than 5,000 from 2016 to 2019).

Read also: How has Covid-19 impacted the Australian property market?

Increasing Supply

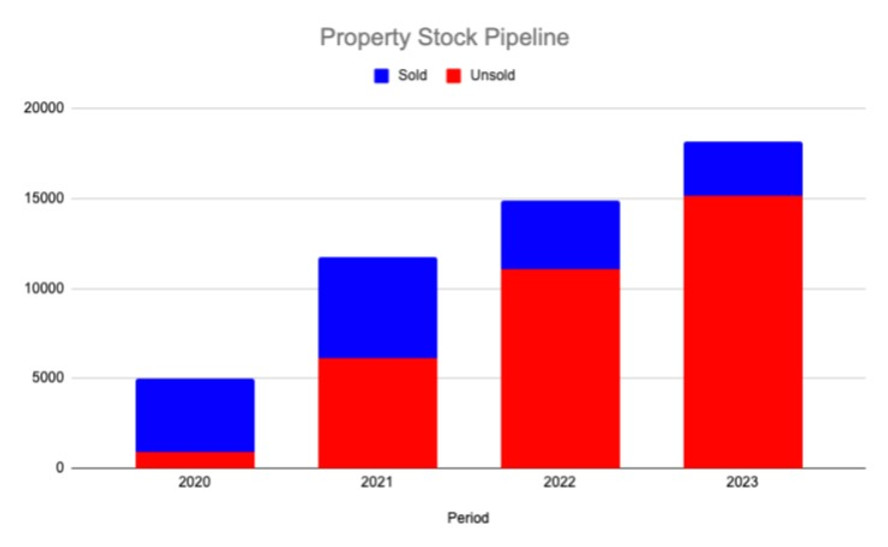

From 2020 to 2023, the private non-landed residential market is expected to receive approximately 50,000 new properties, representing a 16% increase in property stock. This can be attributed to the en-bloc frenzy in 2017 – 2018 when the developers bought many en-bloc sites for redevelopment.

The monetary Authority of Singapore (MAS), in its Financial Stability Review 2019, had warned that ‘the increase in unsold inventory could place downward pressure on prices in the medium term’. In addition, developers who fail to sell all their units within five years will be hit by ABSD. This will put more pressure on the property price.

Executive Condominiums (ECs) Grants and Income Ceiling

The increase in grants available for first-time EC buyers as well as an upward revision of the income ceiling for buyers will pull away the demand for private residential properties. This will further exacerbate the supply gut in the coming years.

Conclusion

There are many downsides to Singapore’s non-landed residential market in the coming years. First, the supply glut may force developers to slash prices of unsold units to avoid the ABSD. Second, the vacancy rate may rise due to the increasing supply of units. Third, the global situation is expected to improve in the coming years which may slow the inflow of capital into Singapore.

Written by: Hong Jia Jun and Oliver Siah

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.