What does COVID-19 mean for real estate in Singapore?

COVID-19 may have stifled global market sentiment, provoked fears of a recession and the intermittent panic buying of toilet paper. Currently, all we hear and think about is the impact of the COVID-19 outbreak affecting everyone in all aspects of work and life, including the real estate market. So, the question is, how has COVID-19 impacted the Singapore real estate market?

The attractiveness of Singapore real estate

The Singapore government is receiving ‘praises for the remarkable containment and handling of COVID-19’, which has been a great strength and provided faith for many Singaporeans and even foreigners. The foreign demand in the Core Central Region (CCR) is still seen to be buoyant. In the eyes of foreigners, Singapore is standing out amongst the rest of the cities as a safer and more desirable place for real estate investments.

– Ismail Gafoor, CEO of PropNex, EdgeProp

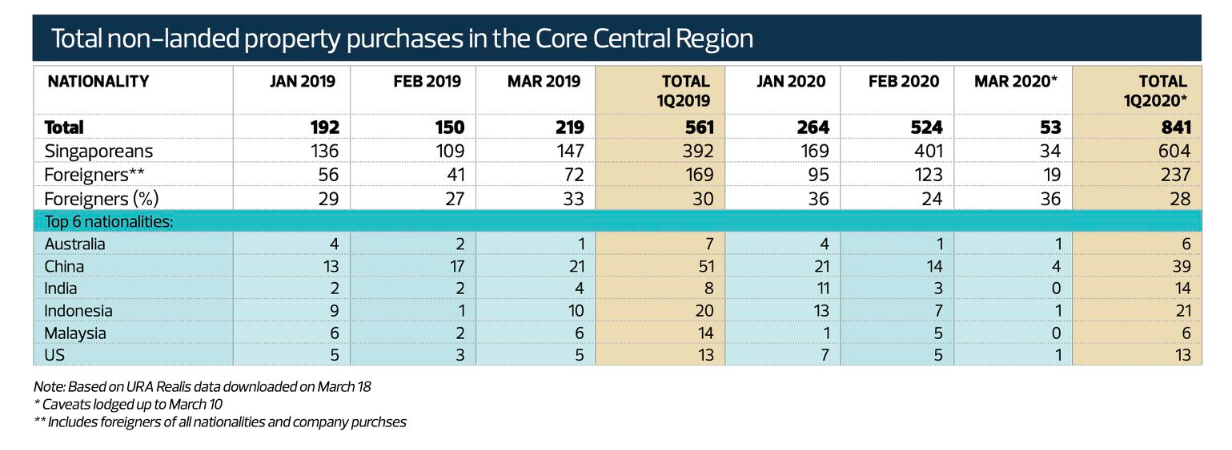

Though we are still in the early stages and despite travel bans that have been put to effect since the start of February, EdgeProp has indicated that the percentage of foreigners’ purchases of non-landed property in CCR has increased from the same period in 2019. The table below expresses that the foreign demand for CCR is still going strong.

Information by EdgeProp

Price decrease

However, with all that said, according to flash data from the Urban Redevelopment Authority (URA) as of April 1, 2020, the prices of private residential property have decreased by 1.2% in the last 3 months from the last quarter of 2019. Prices of non-landed homes have also dropped, CCR fell by 1.5% while those in the outside central region (OCR) dropped by 1 per cent.

Ms. Christine Sun, head of research and consultancy at OrangeTee & Tie, has predicted that there will not be major price corrections in the following months despite the declining condition of COVID-19. Additionally, if prices were to show signs of an abrupt decrease, the government can potentially promote cooling measures to stimulate demand, which will allow prices to be more resilient compared to previous recessions, says Mr. Wong Xian Yang, Cushman & Wakefield’s senior manager for research.

Investor’s perspective

Mr. Ismail Gafoor, CEO of PropNex Realty, is predicting a 2 to 3% drop in property prices in 2020, given the current market sentiment. Which would be the perfect time for genuine buyers to take advantage of the lower interest rates to invest in “rightly priced” and hard-to-come-by projects. In addition, as the Singapore interbank offered rate (SIBOR); how home loans are secured, spiraled downwards in recent weeks, as the US Federal Reserve’s emergency slashed its key rate to near zero.

From an investment perspective, real estate has defensive investment characteristics, providing stable cash flow with the ability to tailor rents to manage occupancy and of course, the benefit of diversification.

Although investments in real estate have fluctuated over the years through numerous downturns, the overall trend has been higher for real estate and, JLL Research & strategy has reported they see no reason for this trend to reverse. As real estate continues to offer good returns in comparison to other forms of investments.

Read also: How has Covid-19 impacted Singapore home rental market?

Conclusion

Singapore’s CCR continues to attract foreigners and is holding demand, despite the situation, as the percentage of foreign buyers of non-landed CCR properties have increased from the same period last year. Overall, the data provided by the URA has indicated price decreases of private residential property by 1.2% in the last 3 months from the last quarter of 2019. However, prices are not expected to have a dramatic decrease. With the current market sentiment, a price decrease of 2 to 3% is small compared to the stock markets which had suffered high double-digit losses. With global interest rates including our SIBOR, trending downwards, it may present an opportunity for property investors to enter the market.

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.