How has Covid-19 impacted the Australian property market?

As Australia is now more than a month into COVID-19 lockdown restrictions and Australians are settling into this new normal, it goes without saying that it has been a tumultuous month for the economy and the property markets.

Decrease in property prices

At the beginning of this month, settled property sales had been trending higher and most cities had executed a recovery from the preceding housing market downturn. The trends were generally positive across each of the capital cities, as mentioned by Michael Yardney, Director of Metropole Property Strategists.

However, as Australia enters its 6th week of lockdown along with the government’s shutdown of non-essential services, the temporary ban on auctions, open inspections ,and face-to-face meetings have made a negative impact on the property markets. We are starting to see a dip in housing markets due to a decrease in consumer confidence and weaker economic conditions, as the lockdown restrictions progress.

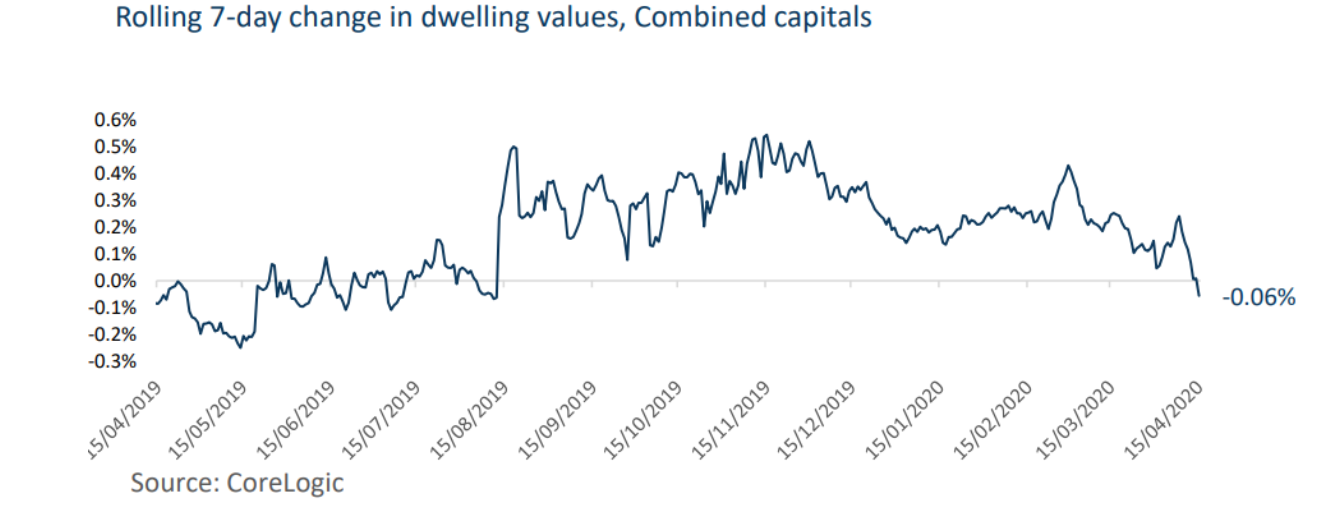

According to CoreLogic’s hedonic house price index, there has been a loss of momentum in housing value growth rates since mid-March, with data through to mid-April seeing a continuation of this trend. As the combined capital cities measure shifts into negative territory week-by-week for the first time since early August last year. The graph below expresses this change in values for the combined cities.

With the sharp incline in unemployment expected to hit 10 percent, Shane Oliver, AMP Capital’s chief economist, believes this could mean an escalation of debt-servicing problems, forced sales, and plummeting property prices of up to 20 percent. This may result in properties being offered on the market at distressed prices.

Decrease in interest rates

The Reserve Bank Board (RBA) reduced the cash rate twice in March 2020, to 0.25 percent, which aims to flood the market with cash to stave off a recession. With the cash rate sitting at a new record low, we expect costs of fixed-rate mortgage products to reduce significantly. To hopefully, boost the cash flow of businesses and the household sector as a whole and might be the perfect opportunity to invest for some.

Investor’s perspective

With the plummeting property prices expected to drop to as low as 20 percent along with the cash rate at an all-time low of 0.25 percent, this might be the perfect time to invest in property. If you are a genuine buyer, in a good financial position, with good job security; this might be the opportunity for you.

From an investment perspective, real estate is a defensive investment and is usually less volatile than other investments. Real estate provides long-term returns as the price increases, in addition, the stable cash flow with the ability to tailor rent to manage occupancy serves as a source of income till the eventual sale.

Despite the great fluctuation of real estate prices over the years through the various downturns (as depicted in the chart above), Australia’s popularity has resulted in an increasing and continuous international immigration over the years. Klear Picture, an investment specialist firm predicts, that this trend is not expected to slow down in the coming years. With significant continual demand, a shortage of residential properties in the country will continue to rise, which will translate to better rental yields and rising capital growth for investors. This displays the perfect opportunity for property investors looking for investments with positive growth potential and high return on investment.

Conclusion

The coronavirus outbreak will impact the Australian housing market, as the lockdown progresses. This is largely due to the decrease in consumer confidence, weaker global economic conditions, and lockdown restrictions. We expect this situation to lower the price expectations of current property owners who are unable to weather the coming market uncertainties hence presenting a good opportunity for investors to pick up such distressed properties. In addition, with the RBA cash rate going down, investors who lock in mortgage contracts during this period can expect a lower cost of funding their property investments.

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.