Singapore’s Property Cooling Measures: How does it affect your property investment?

From the latest Real Estate Sentiment Index published by NUS Real Estate (Q3 2020), property cooling measures recorded the highest quarter-on-quarter increase among the risk factors. Growing from 5.8% in Q2 to 19.2% in Q3, senior executives are growing increasingly cornered about government intervention to cool the property market in the next 6 months.

First introduced in 2009, Singapore’s property cooling measures are government policies aimed to encourage fiscal prudence in residential property purchases and prevent the rapid escalation of property prices that are wildly deviant from Singapore’s economic fundamentals. In the past decade, the measures introduced include: “Additional Buyer Stamp Duty, Seller Stamp Duty, Loan-to-Value and Total Debt Servicing Ratio” which will be further elaborated below.

1. Additional Buyer’s Stamp Duty (ABSD)

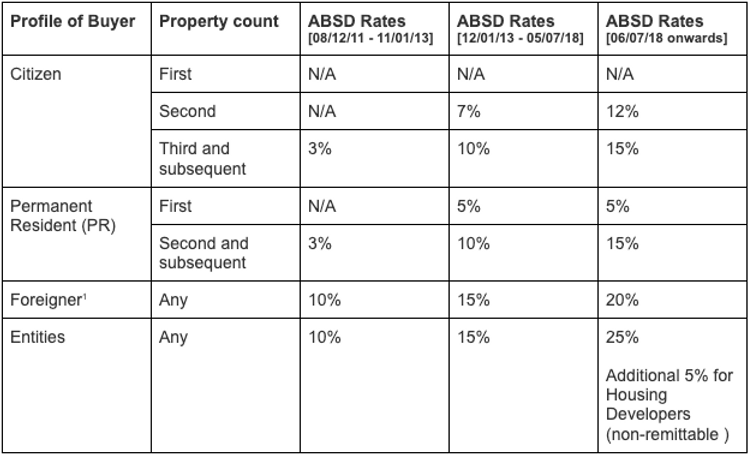

Additional Buyer Stamp Duty (ABSD) is a tax paid on residential property transactions on top of Buyer Stamp Duty. Similar to the Buyer Stamp Duty, it is computed on the purchase price as per the dutiable document or market value of the property (whichever is higher). The government objective of introducing ABSD is for buyers to be financially prudent and keep housing prices affordable for Singaporeans.

Prior to 2011, property prices were rising fast due to strong investment demand. In December 2011, ABSD was introduced to cool the residential market through tapering demand by increasing the initial capital required for property purchase. Later, the rates were revised upwards during January 2013, due to further acceleration and escalation of residential property prices. The latest round of ABSD rate revision happened in July 2018.

The ABSD rate will depend on the purchaser profile as at the date of purchase or acquisition of the residential unit.

Note: (1) Citizens of the USA, Switzerland, Liechtenstein, Norway, Iceland will be treated the same as Singapore Citizens due to the FTA agreement.

Under the entity’s rate, some exemptions granted by the government to housing developers are the ABSD remission of 25%. Instead of paying 30%, housing developers only have to pay for 5% and enjoy 25% remitted, provided they sell all units within 5 years. Such terms and conditions were slated to prevent land banking in Singapore where land as a physical resource is extremely scarce.

2. Sellers’ Stamp Duty (SSD)

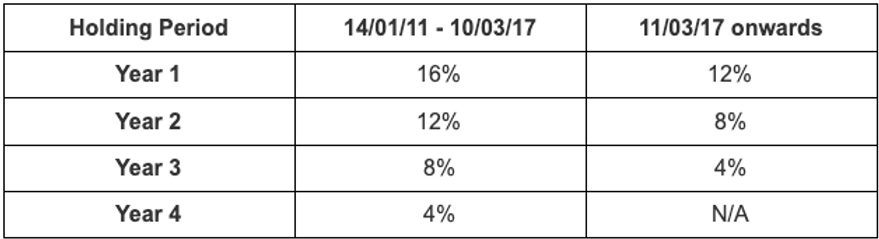

Sellers’ Stamp Duty is a form of property tax on sellers if the property is transacted within 3 years of purchase. This translates to a minimum holding period of 3 years to avoid any penalty. The amount payable is dependent upon seller price as stated in dutiable documents of current market value (whichever is higher).

SSD is chargeable on both residential and industrial properties. This particular stamp duty was brought about to prevent property flipping and change of hands of property within a short period which may cause market disturbance and fluctuation.

SSD is applicable even if a property is acquired through transfer such as in a situation of divorce or inheritance. The few factors affecting SSD amount are when the transaction took place, holding period, and SSD percentage rate. SSD is payable on all residential properties and residential lands that are bought on or after 20 Feb 2010 and sold within the holding period.

As observed from the table above, the SSD rate is in an inverse relation with the holding period. The shorter the holding period, the higher the SSD rate.

Despite the SSD being a mandatory property tax, property sellers may also look under the Inland Revenue Authority of Singapore (IRAS) website for some exemption situations.

3. Loan-to-Value (LTV) Ratio

Loan to value (LTV) ratio is the housing loan quantum set by the Singapore Government that a bank or financial institution is allowed to lend to a property buyer to finance one’s property purchase. LTV ratios act as a limiting factor so as to safeguard borrowers against over-leveraging, capping the financing amount one could get for a loan. It determines the amount of downpayment required to be paid upfront by the property purchaser.

Accompanying LTV is the loan tenure. It gives a ceiling to the loan duration allowable for both HDB and non-HDB properties. HDB property buyers can loan up to a period of 30 years whereas non-HDB property buyers can loan up to 35 years. However, a higher rate may be charged for tenures extending past the borrower’s 65th birthday.

LTV ratios are calculated according to the age of the borrowers. In the case of a joint borrower situation, the formula below calculates the weighted average weight to determine the maximum LTV one may obtain in their property purchase.

Income Weighted Average Age:

Source: https://www.srx.com.sg/cooling-measures

4. Total Debt Servicing Ratio

Total Debt Servicing Ratio refers to the ceiling a borrower can loan from the bank. MAS slates for property loans to account for TDSR and not exceed the maximum of 60% which is the determined threshold.

Implemented in June 2013, the total debt servicing ratio was a cooling measure applied to debt servicing framework for property loans. It was to regulate the maximum borrowing of a person with regards to property loans. It encourages borrowers to borrow and purchase within financial capability and limits, to reduce the risk of loan defaults. In 2016, tweaks were made to the TDSR requirements after the Monetary Authority of Singapore (MAS) received feedback.

TDSR rules are only applicable to individual borrowers. Corporate entities do not have to follow the TDSR framework as they have compliance with other criteria sets. However, it is to note that if an individual setting up a company solely to purchase property, then financial institutes would have to do due diligence checks and apply TDSR rules.

TDSR is calculated using the following formula:

Monthly debt would include all current outstanding debt obligations.

Conclusion

Amidst an expected 6% shrink in the Singapore economy, rising unemployment, and slower wage growth, the property market has remained resilient through 2020. With National Development Minister Desmond Lee’s reiteration on the importance of property cooling measures in Singapore, only time will tell if the next set of property cooling measures are set to be rolled out in 2021.

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.