Why are prices of landed private residential property rising despite the pandemic?

Investments in the stock market and digital currencies have higher risks with their heightened levels of speculation. However, investments in private residential properties have generally proven to provide a more stable risk-adjusted return. Residential properties are generally regarded as assets that can weather economic downturns and a stable store of wealth, as well as capital appreciation.

Why is there a Growing Demand for Private Residential Properties?

With the increased volatility in stock markets caused by the pandemic, investors are looking to reinvest in lower-risk assets such as properties. This flight to stability is enhanced by other domestic and international factors.

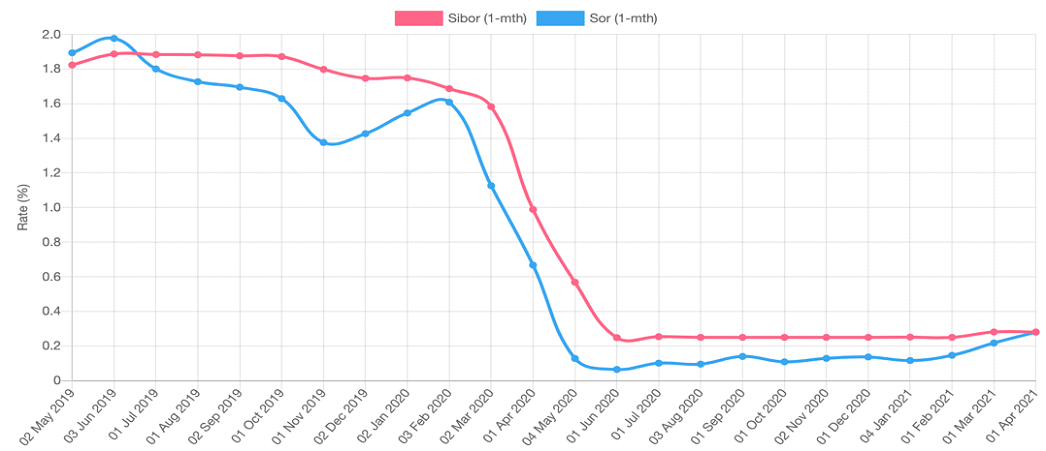

Domestically, travel restrictions have increased the purchasing power of the upper-middle class (who were left mostly unscathed by the pandemic) with their reduced expenditure on overseas travel and entertainment. Furthermore, as illustrated by the chart below, stimulus policies had created a low-interest rate environment since the beginning of the pandemic, increasing the affordability of property purchases. In tandem, both factors are the primary drivers of increased demand for private residential properties.

Singapore Interbank Offered Rate (SIBOR)

Other international factors include the inflow of capital into Singapore as foreigners and businesses reallocate their investments. With its low tax regime and effective control of the Covid-19 outbreak, Singapore has been seen as a safe haven especially amongst the wealthy in Asia – total deposits of non-resident foreigners have increased 20% y-o-y since January 2020, exceeding S$64.2 billion. In April 2021, HK-listed Want Want China Holdings Chairman Tsai Eng-Meng and Son purchased the entire Eden Tower at 2 Draycott Park for S$293 million (or S$4,827 psf). This recorded breaking sale excludes the 15% Additional Buyer Stamp Duty applicable to Singapore permanent residents.

Read also: 4 Property trends to take note in 2021

A closer look at Landed Private Residential Properties

The small city-state of Singapore has been an ideal hotspot for property investments, and this is especially so for landed properties that only make up 5% of Singapore’s real estate. The constantly growing demand for limited land supply enhances the value of private residential properties in Singapore.

According to Mr. Nicholas Mak, Head of Research & Consultancy at ERA Realty, the pandemic has led to a higher demand for larger living spaces. Singapore’s work from home regulations, amongst other key factors, have resulted in an increased interest in sourcing new properties with a focus on perfecting the homestay experience. This has led to more people being willing to spend on homes where they spend most of their time.

The growing demand with the fixed supply of land would increase the price of such landed properties, securing profits for investors. This is reflected in the first quarter of 2021, where the private residential property price index saw a fourth consecutive increase to 162.2 points, according to the Urban Redevelopment Authority (URA). The higher home prices were led by a stronger 6.7% increase in landed properties in just the first quarter.

Overall increases in non-landed private property prices also contribute to the rising demand for landed properties as such increases make landed housing appear to be more valuable. According to Mr. Leonard Tay, Knight Frank Singapore’s research head landed property prices climbed in Q1 2021 largely due to interest in Good-Class Bungalows (GCBs) from ultra-high net worth individuals. “With landed home supply not likely to increase significantly, these homes have become the new blue-chip,” Mr. Tay added.

In general, there is a noticeable upward trend in demand for landed properties given the limited supply of land. This has led to a stark difference in price appreciation between landed and non-landed properties, with the former having a notably higher value appreciation in the past decade.

Read also: Singapore’s Non-Landed Private Residential Market Outlook

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.